Swapping tokens: Efficient Trading Strategies for Cryptocurrency Investors

The World of Cryptocurrency Trading is fast-paced and unforgiving. With the rise of market volatility, investors must be constantly on the lookout for profitable opportunities to maximize their returns while minimizing their losses. One strategy that has gained significant attention in recent years is swapping tokens – a clever technique that allows traders to exchange one cryptocurrency for another without actual buying or selling.

What are tokens?

Before we dive into the world of token trading, it’s essential to understand what tokens are. In Simple Terms, A token, A Digital Asset That Repressens Ownership or Interest is in a particular project, Organization, OR Commodity. Tokens can be created on top of blockchain platforms, such as ethereum (ETH) or Bitcoin (BTC), and sacrifice unique features like smart contracts, decentralized finance (defi), or gaming.

Swapping tokens: A Strategy for Profit

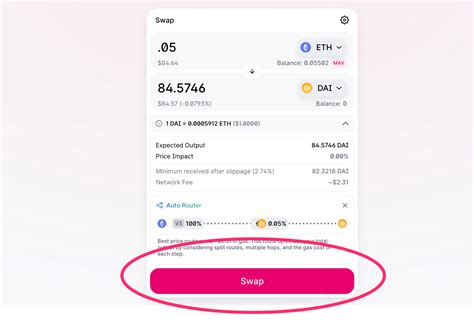

Swapping tokens is an effective way to profit from Market Fluctuations in the cryptocurrency space. Here’s a step-by-step guide on how to swap tokens:

- Identify Your Goals : Before You Start Swapping tokens, It’s Crucial to Define Your Investment Strategy and Risk Tolerance.

- Choose your assets : Research and select the cryptocurrencies you want to trade, including the target token and the trading pair (E.G., ETH/USD).

- Find a reputable exchange : Select an online cryptocurrency exchange that supports your chosen asset pair, such as binance, coinbase, or cracks.

- set up your account : create a new trading account on the selected exchange and fund it with sufficient balance for trading purposes.

- Monitor Market Conditions : Continuously Monitor Market News, Prices, and Trends to Identify Potential Opportunities for Token Swaps.

types of token swaps

There are Several Types of token Swaps available:

- Market-to-Market (MTM) Swap : This is the most common type of swap, where traders buy or sell one cryptocurrency at a fixed price and then swap it with another asset at an agreed-upon rate.

- Maker-Taker Swap : In this scenario, traders enter a swap with an intermediary (maker) who provides liquidity for both assets, allowing them to benefit from market fluctuations in multiple markets.

- PAIR Trading : This Involves Monitoring the Performance of Two or More tokens and Swapping Them When One Asset’s Price Increases While the Other’s Decreases.

Efficient Trading Strategies

Swapping tokens is a high-risk, high-repward strategy that requestes careful analysis and market timing. Here are some efficient Trading strategies to Consider:

- Dollar-cost Averaging : Spread Your Investments Across Multiple token Swaps to Minimize Risk.

- News-based trading : Stay up-to-date with market news and price movements to identify potential opportunities for Token Swaps.

- Price-Action Trading : Monitor the prices of individual assets and swap them when one asset’s price increeases while the other’s decreases.

- Risk-Reward Analysis : Continuously Assess The Risks Involved in Each Token Swap and Adjust Your Strategy Accordingly.

Conclusion

Swapping tokens is a sophisticated trading technique that request research, market knowledge, and a solid understanding of risk management strategies. By following these guidelines and staying informed about market conditions, you can increase your chancs of success in the world of cryptocurrency investing.

Disclaimer: Token Swapping Involves High-Risk, High-Reward Investments. Always Conduct Thorough Research and Consider Your Own Risk Tolerance Before Trading. Cryptocurrency Markets Can Be Volatile, and Losses are Possible. Never Invest More Than You Can Afford to Lose.