Liquidity pools importance Cardano (ADA) and risk management

The cryptocurrency world has received a lot of attention in recent years as many investors are flocking to space in search of quick profits. However, the essential aspect that is often overlooked is the importance of liquidity pools in cryptocurrency markets. In this article, we will go into the importance of liquidity pools in Cardan (Ada) and investigate how they influence risk management.

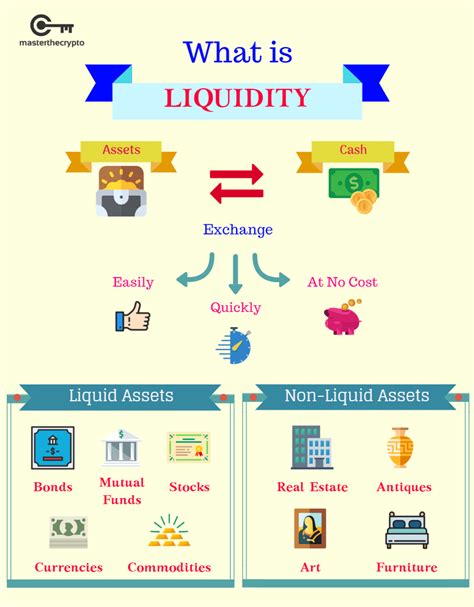

** What are the liquidity pools?

The liquidity fund is a circuit liquidity mechanism that allows consumers to borrow or lend their ADA tokens, and there is no need to communicate with centralized exchange. This technology gives traders the opportunity to create a decentralized, automated property purchase and sale market, which in turn helps maintain price stability and reduce volatility.

** Why are liquidity funds important for Cardano (Ada)?

Cardano (Ada) is one of the most promising cryptocurrency market, focusing on scales, security and decentralization. One of the main properties of ADA that distinguishes it from other cryptocurrencies is the use of liquidity deposits.

The benefits of liquidity pools in ADA:

1

2.

- Improved market efficiency : Liquidity deposits help to create a more efficient market by reducing the time needed to purchase or sell assets, which can lead to lower prices and increase trading volume.

** How do liquidity funds work in Cardano (Ada)?

Cardano liquidity funds are created by creating a new access key called “Adaptual”. This access key is used as a hostage to borrowing liquidity, allowing consumers to borrow an Ada by promising to return it at a stable rate. The pool is supervised by a group of approvalrs who agreed to maintain the stability of the protocol.

Risk management

Liquidity swimming pools also play a crucial role in controlling Cardan (Ada). By providing a decentralized and automated market, liquidity funds help to mitigate the risks associated with traditional exchange.

1

2.

- Improved Optimization of Trade Strategy

: Giving liquidity of various markets, liquidity funds help traders optimize their trade strategies by increasing their profits potential.

Conclusion

In conclusion, liquidity funds are a critical component of the Cardano (Ada), which plays a vital role in maintaining price stability, increasing trade volume and improving market efficiency. By reducing volatility, improving market efficiency and increasing risk management, liquidity funds can become a gaming converter in cryptocurrency space.

As the acceptance of cryptocurrencies continues to grow, it is very important to understand the importance of liquidity pools and how they can affect your investment strategy. Whether you are an experienced merchant or just starting, invest in the Cardano (Ada), a well -informed understanding of liquidity deposits, is very important for success in this rapidly developing market.

Refusal of Responsibility: This article is only for information purposes and should not be considered tips as investment. The cryptocurrency markets are by nature volatile and previous results do not guarantee future results.